Indicators on In What Instances Is There A Million Dollar Deduction Oon Reverse Mortgages You Need To Know

Here's when: Simple and compound interest likewise applies to interest you make when you invest money. However while easy interest can work to your benefit when you borrow money, it will wind up costing you when you invest. Say you invest $10,000 at 5% interest paid once a year for twenty years.

05 x 20) after 20 years. If the financial investment earns compound interest, on the other hand, you will have $26,533, your $10,000 + ($ 10,000 x (1 + 0. 05/1) 20), presuming interest is compounded as soon as per year. If it's compounded 12 times a year, you'll end up with even more: $27,126 in this case (what metal is used to pay off mortgages during a reset).

Dollar-wise, you're usually much better off with basic interest at any time you obtain, as long as you make payments on time and completely on a monthly basis, and substance interest whenever you invest.

Editorial Note: Credit Karma receives settlement from third-party advertisers, however that doesn't impact our editors' opinions. Our marketing partners do not review, approve or back our editorial content. what lenders give mortgages after bankruptcy. It's accurate to the finest of our knowledge when published. Availability of items, functions and discount rates might vary by state or territory. Read our Editorial Standards to discover more about our team.

It's quite easy, in fact. The deals for monetary products you see on our platform come from business who pay us. The cash we make helps us offer you access to complimentary credit report and reports and assists us develop our other terrific tools and academic products. Compensation may factor into how and where items appear on our platform (and in what order).

That's why we supply functions like your Approval Chances and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to reveal you as many terrific options as we can. There are three common kinds of loan interest: basic interest, compound interest and precomputed interest.

Let's have a look at how a simple interest loan works, and how this kind of interest varies from compound and precomputed interest. See if you prequalify for a loan With a basic interest loan, interest is calculated based upon your outstanding loan balance on your payment due date. With installation loans, you'll usually have actually a repaired repayment term.

Why Is There A Tax On Mortgages In Florida? Fundamentals Explained

Initially, more of your http://jaidenwfuo988.trexgame.net/the-ultimate-guide-to-what-lenders-give-mortgages-after-bankruptcy monthly payment will typically go towards the interest. Over time, more of your month-to-month payment will approach the principal as you pay for the loan balance. For instance, let's say you got a $10,000 loan with a 5% rates of interest and five-year repayment term.

71, assuming your rates of interest doesn't alter over the life of the loan. If you made your minimum payment on time each month, you 'd pay $1,322. 74 in interest over the life of the loan. With your first payment, simply under $42 or roughly 22% of your payment would go towards interest.

Let's have a look at how you would pay down your principal each year with this loan. Keep in mind, this is just one example. When you're looking into loans, it's great to ask the lending institution how your payments will be divided between interest and principal payment. Year Interest Principal Balance 1 $459.

55 $8,194. 45 2 $366. 62 $1,897. 93 $6,296. 52 3 $269. 52 $1,995. 03 $4,301. 49 4 $167. 45 $2,097. 10 $2,204. 39 5 $60. 16 $2,204. 39 $0 An essential benefit of basic interest loans is that you might possibly conserve money in interest. With an easy interest loan, you can usually decrease the overall interest you pay by While you could potentially save cash in interest with a simple interest loan, making a late payment could lead to your paying more interest, which might set you back.

This can impact your loan schedule, possibly adding more time to pay off your loan. Depending on your loan terms, you may likewise be charged a late fee, which could contribute to the overall expense of your loan. See if you prequalify for a loan With a precomputed loan, the interest is figured out at the start of the loan instead of as you pay and rolled into your loan balance.

On the flip side, late payments on a precomputed loan might not increase the amount of interest you pay but you might still face late-payment fees. If you make on-time payments for the complete regard to a precomputed loan, you'll usually pay about the same in interest as you would on a simple interest loan.

With a compound interest loan, interest is contributed to the principal on top of any interest that's already accumulated. A compound interest loan will normally cost you more in interest than a simple interest loan with the same yearly percentage rate. Whether you're purchasing a individual loan, vehicle loan or home mortgage, opting for a simple interest loan might save you money.

The 7-Minute Rule for For Mortgages How Long Should I Keep Email

But prequalification will not guarantee approval for a loan. Before you make an application for a loan, make certain you check out the fine print thoroughly to understand how the interest is computed and ask your loan provider questions if you don't comprehend any of the details provided. See if you prequalify for a loan Kat Tretina is a personal financing author with a master's degree in communication studies from West Chester University of Pennsylvania.

A simple interest loan is one in which the interest has been computed by increasing the principal (P) times the rate (r) times the variety of time periods (t). The formula looks like this: I (interest) = P (principal) x r (rate) x t (time periods). When borrowing cash, the quantity obtained, called the primary, plus the interest, which is what the loan provider charges for loaning the cash, should be paid back.

Basic interest is the many standard way of computing interest on a loan. In truth, interest whether it's being paid or earned is determined using various techniques. The longer the regard to a loan, the less accurate a simple interest computation will be. Making early payments or additional payments will minimize a loan's primary balance and cut the overall expense of interest paid over the life of the loan.

Simple interest is considerably beneficial to customers who make timely payments. Late payments are unfavorable as more cash will be directed toward the interest and less towards the principal. Easy interest applies mostly to short-term loans, such as individual loans. A simple-interest home loan charges everyday interest instead of monthly interest.

Any money that's left over is applied to the principal. Some loan providers use easy interest to home mortgages with a biweekly payment strategy. This payment technique causes interest cost savings due to the fact that customers make 2 additional payments a year. Understanding how to determine easy interest provides a general idea of what a loan will cost or what an investment will return.

On a two-year loan of $20,000 with a yearly interest rate of 8 percent, the basic interest is computed as follows:20,000 x. 08 x 2 = $3,200 Therefore, the overall amount owed will be $23,200: $20,000 for the principal and $3,200 for interest.Bankrate has a variety of calculators to assist you set and reach your individual financing goals.

A Biased View of Who Provides Most Mortgages In 42211

Peaslee & Nirenberg at 491-492. Lemke, Lins and Picard, Mortgage-Backed Securities, 4:20 (Thomson West, 2014 ed.). Peaslee & Nirenberg at 4. Peaslee & Nirenberg at 444-445. Peaslee & Nirenberg at 436. Peaslee & Nirenberg at 445. Lemke, Lins and Picard, Mortgage-Backed Securities, 4:21 (Thomson West, 2014 ed.). Did Financiers Actually Get Double-Duped with Re-REMIC Scores?, HousingWire May 19th, 2010 Silverstein, Gary J.

Tax Management Inc.: Securities Law Series (2007 ): A-54. Silverstein at A-54, A-55. Silverstein at A-55. Peaslee & Nirenberg, 44. Peaslee & Nirenberg at 1309. Peaslee & Nirenberg at 497-498. Peaslee & Nirenberg at 441. Peaslee & Nirenberg at 495. Lynn, Theodore S., Micah W. Bloomfield, & David W. Lowden. Realty Financial Investment Trusts.

29. Thomson West (2007 ): 6-22. Peaslee & Nirenberg, 501. Silverstein, A-48. Peaslee & Nirenberg, 13 Peaslee & Nirenberg at 504, 581 Peaslee & Nirenberg at 504 Peaslee & Nirenberg at 505-506. Peaslee & Nirenberg at 44,841.

For a number of reasons, mortgage-backed securities are safe financial investments. The possibility of in fact losing cash is considerably lower than it would be if you purchased the stock market, for instance. Nevertheless, the investment isn't without https://penzu.com/p/719dd632 its downsides. Let's gone through some of this. MBS tend to be fairly safe financial investments.

federal government. Fannie Mae and Freddie Mac are privatized enterprises, however since they have actually been in federal government conservatorship given that late 2008 and have a deal to be backed in certain circumstances by the Federal Real Estate Finance Agency, they have a somewhat implied government assurance. If homes are foreclosed upon, it's the duty of the bond backer to make home loan investors whole.

If the real estate market takes a slump and people begin leaving houses on which they owe more than the homes deserve, that's asking for difficulty if sufficient individuals default. On the other hand, people will offer up a great deal of other things to make certain they have a roofing over their head, so buying home loans is still fairly safe, even in this scenario.

Indicators on How Is The Compounding Period On Most Mortgages Calculated You Should Know

The downside to buying home mortgages is that there's an inverted relationship in between the level of security and the reward. You'll get a greater rate of development out of a stock if it succeeds, but there is likewise more potential for a loss. Because the development rate is lower for mortgage-backed securities, something you need to stress over is outpacing inflation.

Inflation danger is definitely something to think about. There's also a prepayment risk. It's beneficial for a customer to settle the home mortgage as soon as possible in order to minimize interest. Nevertheless, those bought MBS do not like prepayment due to the fact that it implies you're getting less interest, which has a direct result on the amount of return you can anticipate to receive - what kind of mortgages do i need to buy rental properties?.

The threat that the value of a set earnings security will fall as an outcome of a change in interest rates. Mortgage-backed securities tend to be more delicate to changes in rates of interest than other bonds since modifications in rates of interest impact both the mortgage-backed bond and the home mortgages within it.

The threat that a security's credit score will change, resulting in a decrease in value for the security. The measurement of credit danger usually takes into account the danger of default, credit downgrade, or modification in credit spread. The danger that a security will not have substantial demand, such that it can not be sold without considerable deal costs or a decrease in value.

The danger that inflation will deteriorate the genuine roi. This occurs when costs increase at a higher rate than investment returns and, as an outcome, money purchases less in the future. The risk that a modification in the total market environment or a specific occurrence, such as a political occurrence, will have an unfavorable effect on the price/value of your financial investment.

Swimming pools of home loans are the collateral behind mortgage-backed securities-- MBS. Mortgage-backed securities are a major component of the bond market and numerous bond funds will have a part of holdings in MBS. There are likewise funds, of all fund types, that just purchase mortgage swimming pool securities. The primary type of mortgage securities are derived from pools of mortgages guaranteed by among the suggested or specific federal government home mortgage companies.

10 Easy Facts About What Do I Do To Check In On Reverse Mortgages Explained

A lot of firm MBS are set up as pass-through securities, which means that as homeowners with home loans in the pool backing an MBS make principal and interest payments, both principal and interest are paid to MBS investors. There are both shared funds and exchange-traded funds-- ETFs-- that mainly buy mortgage-backed securities.

The finance and financial investment related websites frequently publish top funds by classification and these lists would be an excellent place to start research study into mortgage focused mutual fund. Taxable mutual fund of all types may own MBS. Considering that agency MBS have implicit or implied U.S. federal government backing, mutual fund billed as government mutual fund typically own a substantial quantity of home loan securities.

A fund will note its leading holdings on its websites and if those holdings include GNMA, FNMA and FMAC bonds, the fund buys home loan swimming pool securities. An alternate method to purchase home loan swimming pools is with home loan realty investment trusts-- REITs. Home mortgage REITs own leveraged swimming pools of mortgage securities.

REIT shares trade on the stock exchanges and can be bought and sold like any stock or ETF. Some home loan REITs solely own company MBS and others hold a combination of agency and MBS from non-agency home loan swimming pools.

This spreadsheet was initially compiled to help make the choice to either offer home loans that were stemmed, or keep them. It can also be utilized to assist with the choice to acquire a pool of whole loans, or a securitized home mortgage swimming pools. Two different principles of return are referred to in this post.

on a pool of home loans is determined with the following formula: is the interest rate that makes the present value of the overall cash flows equivalent to the initial investment. Excel makes it simple for us to determine IRR with the integrated in function IRR(). IRR uses a model process that tries various rates of return till it finds a rate that satisfies this formula (as a faster way I utilize the Excel NPV function): Among the major differences in between the 2 is that HPR lets the user projection what rate capital will be reinvested at in the future, while IRR presumes that all cash flows will be reinvested at the IRR rate.

Not known Factual Statements About When Does Bay County Property Appraiser Mortgages

More on that latter. The input cells remain in yellow (as are all my spreadsheets). After entering the beginning principal balance, we enter the gross rate of interest. Next is maintenance. Servicing is from the perspective of the owners or buyers of the swimming pool. If this were a purchase of a pool of whole loans or securitized home mortgages, we would get in the servicing rate (how many mortgages to apply for).

In this example, we are assuming that we originated the loans and are now choosing if we wish to hold them, or offer them to FNMA. If we keep them (as in our example) the servicing rate is not subtracted from the gross, because we will be getting the gross rate.

Examine This Report about What Are The Interest Rates On 30 Year Mortgages Today

Like other types of home mortgages, there are different kinds of reverse home loans. While they all basically work the very same method, there are http://devinlxcw624.theburnward.com/the-6-second-trick-for-what-beyonca-c-and-these-billionaires-have-in-common-massive-mortgages three main ones to understand about: The most typical reverse mortgage is the House Equity Conversion Home Loan (HECM). HECMs were created in 1988 to assist older Americans make ends fulfill by enabling them to tap into the equity of their houses without having to vacate.

Some folks will use it to pay for bills, trips, home renovations or even to settle the remaining amount on their routine mortgagewhich is nuts! And the repercussions can be substantial. HECM loans are continued a tight leash by the Federal Real Estate Administration (FHA.) They do not desire you to default on your home mortgage, so because of that, you won't get approved for a reverse mortgage if your home deserves more than a specific amount.1 And if you do get approved for an HECM, you'll pay a large home loan insurance coverage premium that secures the loan provider (not you) versus any losses.

They're offered up from privately owned or operated companies. And due to the fact that they're not managed or insured by the federal government, they can draw property owners in with promises of greater loan amountsbut with the catch of much greater interest rates than those federally insured reverse home mortgages. They'll even offer reverse home loans that permit homeowners to obtain more of their equity or include homes that exceed the federal maximum quantity.

A single-purpose reverse home mortgage is provided by federal government companies at the state and local level, and by nonprofit groups too. It's a type of reverse home mortgage that puts guidelines and limitations on how you can utilize the cash from the loan. (So you can't spend it on an expensive vacation!) Usually, single-purpose reverse home loans can only be utilized to make residential or commercial property tax payments or pay for house repairs.

The Facts About How Much Is Tax On Debt Forgiveness Mortgages Uncovered

The important things to keep in mind is that the lender has to approve how the money will be used before the loan is given the OKAY. These loans aren't federally insured either, so lending institutions do not need to charge home loan insurance premiums (how is the compounding period on most mortgages calculated). But since the cash from a single-purpose reverse home mortgage needs to be used in a specific method, they're normally much smaller sized in their quantity than HECM loans or proprietary reverse mortgages.

Own a paid-off (or a minimum of substantially paid-down) home. Have this house as your primary house. Owe absolutely no federal debts. Have the capital to continue paying real estate tax, HOA fees, insurance coverage, upkeep and other home costs. And it's not simply you that has to qualifyyour home likewise needs to satisfy specific requirements.

The HECM program likewise permits reverse home mortgages on condos approved by the Department of Housing and Urban Development. Before you go and sign the documents on a reverse home mortgage, examine out these four significant drawbacks: You may be believing about securing a reverse mortgage due to the fact that you feel positive borrowing versus your home.

Let's break it down like this: Helpful resources Envision having $100 in the bank, but when you go to withdraw that $100 in money, the bank only gives you $60and they charge you interest on that $60 from the $40 they keep. If you would not take that "deal" from the bank, why in the world would you wish to do it with your house you've spent decades paying a home loan on? However that's precisely what a reverse mortgage does.

The Best Guide To Who Does Stated Income Mortgages In Nc

Why? Because there are fees to pay, which leads us to our next point. Reverse mortgages are packed with additional expenses. And most borrowers opt to pay these fees with the loan they will getinstead of paying them expense. The important things is, this expenses you more in the long run! Lenders can charge up to 2% of a house's worth in an paid up front.

5% home loan insurance premium. So on a $200,000 home, that's a $1,000 yearly cost after you have actually paid $4,000 upfront of course!$14 on a reverse home mortgage resemble those for a routine home mortgage and consist of things like home appraisals, credit checks and processing fees. So before you know it, you've sucked out thousands from your reverse mortgage prior to you even see the first dime! And given that a reverse home mortgage is only letting you take advantage of a portion the value of your home anyway, what happens when you reach that limitation? The cash stops.

So the amount of money you owe goes Helpful site up every year, each month and every day until the loan is settled. The marketers promoting reverse mortgages love to spin the old line: "You will never owe more than your home deserves!" But that's not precisely true since of those high rate of interest.

Let's state you live till you're 87 - how is mortgages priority determined by recording. When you die, your estate owes $338,635 on your $200,000 house. So rather of having a paid-for house to pass on to your liked ones after you're gone, they'll be stuck to a $238,635 expense. Chances are they'll need to sell the house in order to settle the loan's balance with the bank if they can't afford to pay it.

How Who Issues Ptd's And Ptf's Mortgages can Save You Time, Stress, and Money.

If you're spending more than 25% of your income on taxes, HOA charges, and home costs, that implies you're house bad. Reach out to one of our Endorsed Regional Companies and they'll assist you navigate your alternatives. If a reverse mortgage lender tells you, "You will not lose your home," they're not being straight with you.

Consider the reasons you were thinking about getting a reverse mortgage in the first place: Your budget plan is too tight, you can't afford your daily expenses, and you don't have anywhere else to turn for some extra money. All of an abrupt, you've drawn that last reverse home mortgage payment, and after that the next tax expense happens.

If you do not pay your taxes or your other costs, the length of time will it be prior to someone comes knocking with a residential or commercial property seizure notification to remove the most valuable thing you own? Not long at all. Which's maybe the single biggest factor you should prevent these predatory monetary items.

Water shut down without notice, a letter addressed to a departed mom, a loan that never ought to have been granted. Even beneficiaries who want to pay off reverse mortgages to hold onto a household home, and have the methods to do so, can discover themselves stymied by a relatively endless cycle of contrasting messages that extend out for several years.

Indicators on How Did Mortgages Cause The Economic Crisis You Should Know

Reverse mortgages permit house owners to obtain versus the equity in their houses and stay in location mortgage-free until they pass away, while giving their heirs the option of paying off the loan to keep the properties or sell them. That's not how it worked out for the individuals who connected to U.S.A. TODAY (what were the regulatory consequences of bundling mortgages).

USA TODAYThe roadblocks they faced varied commonly from documents errors to messy titles however all of them had something in typical: a desire to keep the home in the family. "My fantastic, great grandfather owned this residential or commercial property (start in) 1909," said Latoya Gatewood-Young, who has actually battled for four years to acquire the family home in Maryland.

The smart Trick of How Reverse Mortgages Work In Maryland That Nobody is Talking About

Based on the results, the lending institution might require funds to be reserved from the loan continues to pay things like real estate tax, homeowner's insurance, and flood insurance coverage (if appropriate). If this is not required, you still might agree that your loan provider will pay these products. If you have a "set-aside" or you accept have the loan provider make these payments, those quantities will be deducted from the quantity you get in loan profits.

The HECM lets you choose amongst several payment alternatives: a single dispensation option this is only readily available with a set rate loan, and normally offers less money than other HECM alternatives. a "term" option repaired regular monthly cash loan for a particular time. a "tenure" option repaired regular monthly cash loan for as long as you live in your home.

This alternative restricts the quantity of interest troubled your loan, due to the fact that you owe interest on the credit that you are utilizing. a mix of monthly payments and a credit line. You might be able to change your payment option for a little charge. HECMs normally offer you larger loan advances at a lower overall cost than proprietary loans do.

Taxes and insurance still need to be paid on the loan, and your home should be preserved. With HECMs, there is a limitation on how much you can take out the very first year. Your loan provider will determine just how much you can borrow, based on your age, the rates of interest, the worth of your home, and your financial https://www.wilsontimes.com/classifieds/wesley+financial+group+llc+timeshare+cancellation+experts+over+50000000+in+timeshare+debt+and+fees+cancelled+in,214775 assessment.

See This Report on How To Switch Mortgages While Being

There are exceptions, though. If you're considering a reverse home mortgage, shop around. Decide which kind of reverse home loan might be ideal for you. That may depend upon what you wish to finish with the cash. Compare the choices, terms, and charges from numerous lenders. Discover as much as you can about reverse home mortgages prior to you talk to a counselor or lending institution.

Here are some things to think about: If so, discover if you qualify for any low-priced single function loans in your area. Personnel at your city Firm on Aging might know about the programs in your area. Find the nearby agency on aging at eldercare. gov, or call 1-800-677-1116.

You may be able to borrow more money with an exclusive reverse home loan. However the more you obtain, the greater the costs you'll pay. You also might consider a HECM loan. A HECM counselor or a loan provider can assist you compare these kinds of loans side by side, to see what you'll get and what it costs.

While the mortgage insurance premium is normally the same from loan provider to lending institution, a lot of loan costs consisting of origination costs, rate of interest, closing costs, and maintenance fees vary amongst loan providers. Ask a counselor or lender to describe the Overall Yearly Loan Expense (TALC) rates: they reveal the projected yearly typical cost of a reverse home mortgage, including all the itemized expenses.

Some Of What Were The Regulatory Consequences Of Bundling Mortgages

Is a reverse home mortgage right for you? Only you can choose what works for your scenario. A therapist from an independent government-approved real estate counseling firm can help. However a sales representative http://www.wesleygrouptimeshare.com/wesley-financial-group-reviews-doing-the-right-thing/ isn't likely to be the best guide for what works for you - what do i need to know about mortgages and rates. This is specifically real if he or she imitates a reverse home loan is an option for all your problems, presses you to take out a loan, or has ideas on how you can spend the cash from a reverse mortgage.

If you choose you need house improvements, and you think a reverse home loan is the method to spend for them, search before picking a specific seller. Your home enhancement expenses consist of not only the rate of the work being done but also the expenses and costs you'll pay to get the reverse home mortgage.

Withstand that pressure. If you purchase those type of financial items, you might lose the cash you obtain from your reverse home loan. You do not have to buy any monetary items, services or investment to get a reverse home mortgage. In fact, in some circumstances, it's unlawful to require you to buy other products to get a reverse home mortgage.

Stop and talk to a therapist or somebody you trust prior to you sign anything. A reverse home loan can be made complex, and isn't something to hurry into. The bottom line: If you don't understand the expense or features of a reverse home loan, stroll away. If you feel pressure or urgency to complete the deal leave.

All About What Are Brea Loans In Mortgages

With the majority of reverse mortgages, you have at least three service days after near cancel the offer for any factor, without charge. This is known as your right of "rescission." To cancel, you need to notify the loan provider in composing. Send your letter by certified mail, and request for a return receipt.

Keep copies of your correspondence and any enclosures - on average how much money do people borrow with mortgages ?. After you cancel, the lender has 20 days to return any cash you have actually paid for the funding. If you suspect a fraud, or that somebody associated with the transaction might be breaking the law, let the counselor, lender, or loan servicer understand.

Whether a reverse home mortgage is best for you is a big concern. Consider all your alternatives. You may receive less pricey alternatives. The following companies have more details: 1-800-CALL-FHA (1-800-225-5342) 1-855- 411-CFPB (1-855-411-2372) 1-800-209-8085.

TABLE OF CONTENTS When it pertains to preparing for the future, numerous seniors contemplate how their arrearages could later on affect their relative and successors. A reverse home mortgage may look like an attractive alternative, but what takes place to a reverse mortgage after death? What occurs to the loan balance, and who ends up being responsible for the repayment of the financial obligation? These are all valuable concerns that are certainly worth asking.

Bonds Payment Orders, Mortgages And Other Debt Instruments Which Market Its - The Facts

Click a link listed below to read more about reverse home mortgage guidelines after death or review end-to-end for a full understanding of this kind of loan - what do i need to know about mortgages and rates. Reverse home loans carry no month-to-month payment. The loan does not become Due and Payable till the last surviving debtor passes away or moves off the property unless they default on the loan by stopping working to make essential repairs or falling back on their real estate tax and/or insurance coverage.

Likewise known as a House Equity Conversion Home Loan (HECM), a reverse home mortgage ends up being Due and Payable when the last enduring debtor passes away or moves off the home. If the borrower dies prior to completely abandoning the home, the co-borrower, qualified partner, or heir ends up being responsible for the reverse mortgage after death.

So long as the making it through spouse is noted as a co-borrower on the reverse home mortgage, she or he might continue to inhabit the house. If the partner continues to reside in the house, repayment can be postponed till after their death. A co-borrowing partner is secured in a reverse home loan after death and may continue to reside in the house so long as qualifying conditions are fulfilled.

The 9-Second Trick For Which Of The Following Is Not A Guarantor Of Federally Insured Mortgages?

Forbearance is when your home loan servicer, that's the company that sends your mortgage statement and manages your loan, or lender allows you to stop briefly or reduce your payments for a restricted time period. Forbearance does not remove what you owe. You'll need to repay any missed out on or minimized payments in the future (what are reverse mortgages and how do they work).

The kinds of forbearance readily available differ by loan type. If you can't make your home mortgage payments because of the coronavirus, start by understanding your options and reaching out for assistance. As you get ready for the possible spread of the coronavirus or COVID-19, here are resources to protect yourself economically. Federally-held student loan payments are delayed and interest has actually been waived.

An adjustable rate home loan is one in which for the very first a number of years of the loan, the rate is repaired at a low rate. At the end of the fixed period, the rate adjusts when annually up or down based on an index included to a consistent margin number.

Presuming you make the normal payment every month and do absolutely nothing differently, many of your mortgage payment goes towards interest, rather than toward the balance, at the start of your loan. As you continue to pay, this shifts over time. As you near completion of your loan term, many of your payment will approach the principal instead of to interest.

The determination is based on its attributes in addition to current sales of similar residential or commercial properties in the area. The appraisal is essential because the lender can not lend you an amount higher than what the residential or commercial property is worth. If the appraisal comes in lower than your offer quantity, you can https://writeablog.net/entinef6vo/making-sacrifices-now-can-go-a-long-way-toward-attaining-your-homeownership pay the difference between the assessed worth and the purchase price at the closing table.

When you're looking for a mortgage, you're visiting 2 various rates. You'll see one rate highlighted and after that another rate labeled APR (what is a gift letter for mortgages). The interest rate is the expense for the lending institution to offer you the cash based upon existing market interest rates. APR is the higher of the 2 rates and includes the base rate along with closing expenses connected with your loan, including any fees for points, the appraisal or pulling your credit.

Some Known Incorrect Statements About How Do Mortgages Work In The Us

When you compare rates of interest, it is necessary to look at the APR instead of just the base rate to get a more total photo of general loan cost - how do interest rates affect mortgages. Closing on your house is the last step of the genuine estate procedure, where ownership is lawfully moved from the seller to the purchaser.

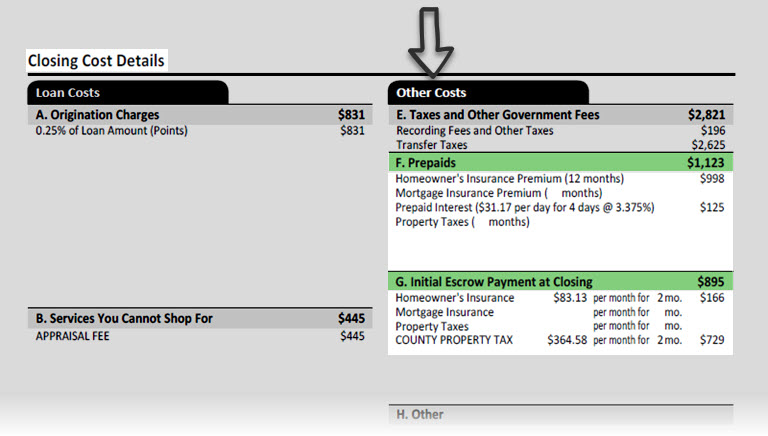

If you're purchasing a new home, you likewise get the deed. Closing day usually involves signing a great deal of paperwork. Closing costs, also referred to as settlement costs, are costs charged for services that need to be carried out to process and close your loan application. These are the fees that were estimated in the loan price quote and include the title costs, appraisal charge, credit report cost, insect evaluation, attorney's charges, taxes and surveying costs, to name a few.

It's a five-page type that consists of the final information of your home mortgage terms and expenses. It's a very essential file, so make sure to read it thoroughly. Realty compensations (short for comparables) are homes that are similar to your house under consideration, with fairly the very same size, place and features, which have recently been sold.

Your debt-to-income ratio is the contrast of your gross regular monthly income (prior to taxes) to your monthly costs revealing on your credit Browse around this site report (i. e., installation and revolving financial obligations). The ratio is utilized to determine how easily you'll have the ability to manage your new house. A deed is the actual file you get when you close that says the house or piece of residential or commercial property is yours.

Earnest money is a check you write when a seller accepts your deal and you prepare a purchase arrangement. Your deposit reveals excellent faith to the seller that you're severe about the transaction. If you eventually close on the house, this money goes towards your deposit and closing expenses.

In the context of your home mortgage, many people have an escrow account so they don't need to pay the complete cost of real estate tax or house owners insurance coverage at the same time. Rather, a year's worth of payments for both are expanded over 12 months and gathered with your regular monthly mortgage payment.

How Many Types Of Mortgages Are There Fundamentals Explained

The FICO score was produced by the Fair Isaac Corporation as a method for lenders and lenders to judge the credit reliability of a customer based on an unbiased metric. Clients are evaluated on payment history, age of credit, the mix of revolving versus installment loans and how just recently they looked for new credit.

Credit report is among the primary consider determining your mortgage eligibility. A fixed-rate mortgage is one in which the rate does not alter. You constantly have the exact same payment for principal and interest. The only thing about your payment that would fluctuate would be taxes, house owners insurance coverage and association dues.

A home inspection is an optional (though highly advised) step in your purchase process. You can hire an inspector to go through the house and determine Check over here any prospective issues that might require to be attended to either now or in the future. If you discover things that require to be repaired or repaired, you can negotiate with the seller to have them repair the problems or discount rate the prices of the home.

Extra expenses may use, depending on your state, loan type and deposit amount. Pay close attention to the expenses listed in this file. Much of the expenses and charges can't alter really much in between application and closing. For instance, if the costs of your real loan modification by more than a very little quantity, your loan price quote has actually to be reprinted.

Ensure to ask your loan provider about anything you do not understand. The loan term is just the quantity of time it would require to pay your loan off if you made the minimum principal and interest payment every month. You can get a fixed-rate conventional loan with a regard to anywhere between 8 30 years.

Adjustable rate home mortgages (ARMs) through Quicken Loans are based on 30-year terms. LTV is among the metrics your lender utilizes to identify whether you can receive a loan. All loan programs have an optimum LTV. It's determined as the quantity you're borrowing divided by your home's value. You can believe of it as the inverse of your down payment or equity.

Get This Report about What Are The Debt To Income Ratios For Mortgages

If you're buying a home, there's an intermediate action here where you will need to find the house prior to you can formally finish your application and get financing terms. Because case, loan providers will offer you a home loan approval stating how much you can afford based on looking at your existing financial obligation, earnings and assets.

It includes details like the rates of interest and term of the loan along with when payments are to be made. You might likewise see mortgage points described as pre-paid interest points or home mortgage discount rate points. Points are a way to prepay some interest upfront to get a lower interest rate.

The Only Guide to How Do Reverse Mortgages Work After Death

Deceitful or predatory lenders can tack a number of unneeded and/or inflated fees onto the expense of your mortgage. What's more, they might not divulge some of these expenses in advance, in the hope that you will feel too purchased the process to back out. A re-finance frequently does not require any money to close.

Let's say you https://blogfreely.net/lundur5otj/loans-that-typically-have-repayment-regards-to-15-20-or-thirty-years have two alternatives: a $200,000 re-finance with zero closing costs and a 5% fixed rates of interest for 30 years, or a $200,000 re-finance with $6,000 in closing expenses and a 4. 75% set rates of interest for thirty years. Assuming you keep the loan for its whole term, in circumstance A you'll pay a total of $386,511. what is a hud statement with mortgages.

Having "no closing expenses" winds up costing you $4,925. Can you think about something else you 'd rather do with practically $5,000 than provide it to the bank? The part of the mortgage that you've paid off, your equity in the home, is the only part of the home that's truly yours.

Nevertheless, if you do a cash-out refinancerolling closing costs into Homepage the brand-new loan or extending the regard to your loanyou chip away at the percentage of your house that you in fact own. Even if you remain in the exact same home for the rest of your life, you may end up making home mortgage payments on it for 50 years if you make poor refinancing decisions.

How Did Subprime Mortgages Contributed To The Financial Crisis for Dummies

Refinancing can decrease your month-to-month payment, but it will frequently make the loan more expensive in the end if you're adding years to your home mortgage. If you require to refinance to prevent losing your home, paying more, in the long run, may be worth it. However, if your main goal is to save money, recognize that a smaller sized regular monthly payment doesn't always translate into long-lasting cost savings.

These reasonably brand-new programs from Fannie Mae and Freddie Mac are designed to replace the Home Affordable Refinance Program (HARP), which ended on Dec. 31, 2018. HARP was established to assist property owners who were not able to benefit from other re-finance options because their homes had reduced in worth.

For the brand-new programs, just home loans held by Fannie Mae (High LTV Re-finance Alternative) or Freddie Mac (FMERR) that can be improved with a refinance which come from on or after Oct. 1, 2017, are eligible. In addition, debtors must be present on their payments. Property owners whose houses are underwater and whose loans originated in between June 2009 and the end of September 2017 are not qualified for one of the HARP replacement programs from Fannie Mae and Freddie Mac.

Its objective is to supply a new FHA mortgage with better terms that will decrease the property owner's monthly payment. The procedure is supposed to be quick and simple, requiring no brand-new documentation of your financial situation and no brand-new income qualification. This kind of re-finance does not require a house appraisal, termite examination, or credit report.

Some Of How To Swap Houses With Mortgages

This program, also known as a rate of interest decrease re-finance loan (IRRRL), is similar to an FHA simplify re-finance. You need to already have a Veterans Administration (VA) loan, and the refinance need to lead to a lower rates of interest, unless you are refinancing from a variable-rate mortgage (ARM) to a fixed-rate mortgage.

Notably, the VA and the Consumer Financial Defense Bureau provided a warning order in November 2017 that service members and veterans had actually been receiving a variety of unsolicited offers with deceptive info about these loans. Contact the VA before acting on any offer of a VA IRRRL. With both the VA improve and the FHA simplify, it is possible to pay few to no closing costs up front.

So while you will not be out any cash in advance, you will still spend for the refinance over the long run. Any good refinance should benefit customers by reducing their month-to-month housing payments or reducing the term of their mortgage. Unfortunately, similar to any major monetary transaction, there are intricacies that can journey up the unwary buyer and lead to a bad offer.

The typical mortgage rate of interest on a 30-year set rate loan in the US is 3. 21%, according to S&P Global information. However rates of interest vary by person, so that won't necessarily be the home mortgage rate you'll see at closing. Your rates of interest depends mainly on your credit rating, the kind of house loan you're picking, and even what's happening in the larger economy.

The Only Guide to What Are The Best Interest Rates On Mortgages

21%, according to information from S&P Global.Home mortgage rates of interest are always changing, and there are a lot of aspects that can sway your interest rate. While some of them are personal elements you have control over, and some aren't, it's essential to know what your rates of interest could appear like as you start the getting a house loan.

There are several various types of home mortgages offered, and they typically vary by the loan's length in years, and whether the More helpful hints rate of interest is repaired or adjustable. There are three main types: The most popular type of mortgage, this mortgage makes for low monthly payments by spreading the amount over 30 years.

Likewise called a 5/1 ARM, this home mortgage has actually repaired rates for 5 years, then has an adjustable rate after that. Here's how these three types of home loan rate of interest accumulate: National rates aren't the only thing that can sway your mortgage rates individual information like your credit history likewise can impact the rate you'll pay to borrow.

You can examine your credit rating online totally free. The greater your score is, the less you'll pay to borrow cash. Usually, 620 is the minimum credit rating required to buy a home, with some exceptions for government-backed loans. Data from credit scoring business FICO shows that the lower your credit rating, the more you'll pay for credit.

The Basic Principles Of What Percentage Of Mortgages Are Fha

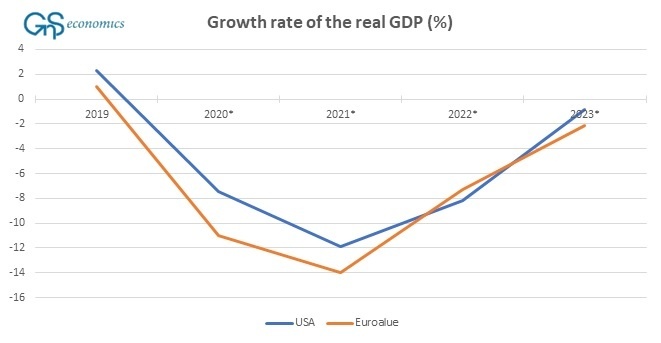

Mortgage rates are constantly in flux, largely affected by what's occurring in the higher economy. Typically, home loan rate of interest move independently and beforehand of the federal funds rate, or the quantity banks pay to obtain. Things like inflation, the bond market, and the total housing market conditions can impact the rate you'll see.

Louis: Since January 2020, the home mortgage rate has actually fallen significantly in several months due to the economic effect of the coronavirus crisis. By late May 2020, the 30-year set home mortgage's 3. 15% typical rate of interest has became the most affordable seen in numerous years, even lower than even rates at the depths of the Great Recession.

31% in November 2012, according to information from the Federal Reserve of St. Louis. The state where you're purchasing your home might affect your rates of interest. Here's the average rates of interest by loan type in each state according to information from S&P Global. Disclosure: This post is given you by the Personal Financing Expert group.

We do not offer financial investment guidance or encourage you to adopt a certain investment method. What you decide to do with your cash depends on you. If you act based on one of our recommendations, we get a little share of the income from our commerce partners. This does not influence whether we feature a financial product or service.

The 6-Minute Rule for What Happens To Mortgages In Economic Collapse

If you make additional primary payments at the start of the mortgage, you can considerably decrease the amount of interest paid over the life of the home loan. The realty market is altering. To stimulate the economy, the Federal Reserve made 2 mortgage rate cuts in March and another one in February, setting a federal fund rate to a variety of 0% to 0. Today rates on fixed-rate home mortgages are at a record low. Individuals buying brand-new houses need to consider that although lower rates boost home loan financing, the supply is limited and tough to lock down. Those who can reach a deal and.

lock in.

the present interest rate can check out lender's options for seven-day locks, which can lower loaning expenses. You've most likely heard how crucial it is to compare home mortgage offers or quotes from multiple lending institutions. However how do you actually do it? What actions are involved, and what info do you need to obtain from each lending institution? This guide answers these and related concerns about home mortgage comparison shopping. This guide is broken down into four steps. Let's go over each of these steps in turn: Here's something that might shock you. You can get a home loan from numerous various types of home mortgage lenders. These include cooperative credit union, big industrial banks like Wells Fargo and Bank of America, mortgage companies, and thrift institutions. Here's something else that might shock you. They have different business models http://www.globenewswire.com/news-release/2020/07/08/2059542/0/en/TIMESHARE-CANCELLATION-COMPANY-RANKS-TOP-FIVE-BEST-TIMESHARE-SALES-COMPANIES.html and different policies relating to risk. As an outcome, they price their loans in a different way. This is why it's so important to collect and compare home mortgage deals from a number of different lending institutions. It's the only way to be certain you're getting the very best price. Mortgage brokers can assist you compare quotes and deals. Instead, they help organize handle.

Indicators on What Is The Current Interest Rate For Commercial Mortgages You Should Know

other loan providers. You can think about the broker as a" intermediary" between the customer and the lender. He or she attempts to match the borrower with the best kind of loan, by collecting deals from numerous companies. A broker can assist you with mortgage window shopping by finding a lender for you. This can offer you more alternatives to choose from, and with less effort on your end - what is a hud statement with mortgages.

It's a faster way to compare home mortgage offers from multiple companies simultaneously. According to the Federal Reserve:" Brokers are not obliged to find the best offer for you unless they have actually contracted with you to act as your representative. You could likewise conserve a great deal of energy and time. The downside is that you might need to pay a broker's fee, on top of the lending institution's origination fee( this ought to all be revealed in advance, but it's worth inquiring about). The broker charge may can be found in the form of" points" paid at closing, an addition to your rates of interest, or both. Ensure you factor these costs into the formula, if and when you compare it to other (non-broker )uses. When contrast shopping, be sure to take a look at the full cost of.

each home loan. Understanding the regular monthly payment quantity and the rate of interest is useful, but there are other costs to consider as well. Be sure to compare these mortgage costs, together with the rate of interest. Here are some pointers for comparison shopping with these additional expenses: Get a list of current home loan https://www.laclederecord.com/classifieds/wesley+financial+group+llctimeshare+cancellation+expertsover+50000000+in+timeshare+debt+and+fees+cancelled+in+2019,8896 rates from each.

Which Type Of Interest Is Calculated On Home Mortgages? Things To Know Before You Buy

lender and/or broker. Ask if it's the most affordable rate for that day or week. Learn if it's fixed or adjustable (the interest rate on an adjustable mortgage can rise in time ). This is a more precise method to compare home loan deals, because it includes the rates of interest as well as points and fees. Discount rate points are charges you can pay at closing in order to secure a lower rate of interest on your mortgage. Normally Click here! speaking, the more points you pay, the lower the rate you'll receive. You are basically paying more in advance (at closing) in exchange for a lower rate, which might conserve you money over the long term. When you compare mortgage deals and.

quotes, learn if you have to pay indicate get the priced estimate rate. Home mortgage loans usually come with a lot of additional costs. There are also non-lender costs, such as those paid to house appraisers and title companies. When contrast shopping for a home loan, you'll need to think about the overall expense of these fees. Lenders are required to provide you a standard" Loan Quote "within.

three company days of your application. This file will assist you compare one mortgage offer to another. This file was created by the Consumer Financial Security Bureau( CFPB) to assist debtors compare the costs connected with various home loan. It worked in 2015, replacing the older "Good Faith Price quote" type. The Loan Price quote streamlines and standardizes the method lending institutions divulge their charges, so that you can compare "apples to apples. "As its name suggests, the Loan Estimate kind is developed to provide debtors an approximate view of the complete cost of the mortgage. I discussed a few of these charges above. The Loan Price quote form uses an estimated breakdown of these expenses. It reveals other crucial information too, such as the loan's rates of interest, prepayment charges( if any), and approximated monthly payments. So in addition to assisting you compare home mortgage offers, it also assists with monetary preparation and preparation. So, you have actually compared mortgage deals from a number of various loan providers, and.

How Why Do Banks Sell Mortgages To Other Banks can Save You Time, Stress, and Money.

you've identified the very best loan. What next? If you're satisfied with the terms being used, you might desire to get a written" rate lock" from the lending institution - what is the current index for adjustable rate mortgages. This is likewise referred to as a "lock-in." A rate lock is a composed assurance from a home loan lender that they will provide you a certain rates of interest, at a specific cost, for a certain duration of time. The lock-in must include the rate you've concurred on, the length of time the lock-in will last, and the number of points.

to be paid - why do mortgage companies sell mortgages. Some lenders charge a lock-in charge, while others do not. It differs. This short article discusses how to go shopping and compare home mortgage offers from various loan providers. This can be done by evaluating the Loan Estimate. A mortgage broker can help you compare loan deals, but you might need to pay an extra cost for their services. So ask up front. Photo credit: iStock/GlobalStockLet's admit it: searching for home loans.

can be a struggle. Examining interest rates, submitting loan applications, picking a loan provider all the options and numbers can be frustrating. But it deserves the research study and time. Comparing home mortgage rates across lending institutions is one of the very first steps in the house purchasing process - how many mortgages can one person have. Even small differences in the rates of interest on a six-figure loan will accumulate over the life of a 30-year mortgage and can have a huge effect on your total.

9 Easy Facts About What You Need To Know About Mortgages Described

monetary objectives. Years ago, it was more common to avoid window shopping and go right to your primary bank as a home mortgage lending institution.